A GmbH (Gesellschaft mit beschränkter Haftung) is one of the most common legal business structures in Germany, offering limited liability to its owners. Similar to an LLC in the U.S. or an Ltd. in the U.K., a GmbH allows entrepreneurs to operate a business while protecting their personal assets from company debts.

Contents

- 1 What is a GmbH?

- 2 Formation and capital requirements of a GmbH in Germany

- 3 Limited liability protection for shareholders

- 4 Differences between GmbH and other legal forms

- 5 GmbH registration process

- 6 Do you want to know more about GmbHs?

- 7 GmbH and international trade

- 8 Financial and accounting obligations for a GmbH

- 9 GmbH vs. limited companies in other jurisdictions

- 10 Insurance requirements for a GmbH

- 11 Investing in GmbHs: Opportunities and risks

- 12 Market presence and reputation of GmbHs

- 13 Trade and competition laws applicable to GmbHs

- 14 Common challenges faced by GmbHs

- 15 Future outlook for GmbHs in Germany

- 16 FREQUENTLY ASKED QUESTIONS

What is a GmbH?

A GmbH is a private limited liability company in Germany, widely chosen by businesses looking for a secure and flexible legal structure. It requires a minimum share capital of €25,000, with at least €12,500 contributed at the time of registration. This structure provides financial security for creditors while allowing business owners to separate their personal and company liabilities.

Types of GmbHs in Germany

Germany offers several variations of the GmbH, including:

- UG (Unternehmergesellschaft): A “Mini-GmbH” with lower capital requirements.

- GmbH & Co. KG: A hybrid model combining a GmbH with a limited partnership.

- gGmbH (gemeinnützige GmbH): A non-profit version of the GmbH.

Formation and capital requirements of a GmbH in Germany

The standard capital requirement for a GmbH is €25,000, which can be monetary or in assets (e.g., equipment, property). Non-monetary contributions must be valued fairly according to market standards.

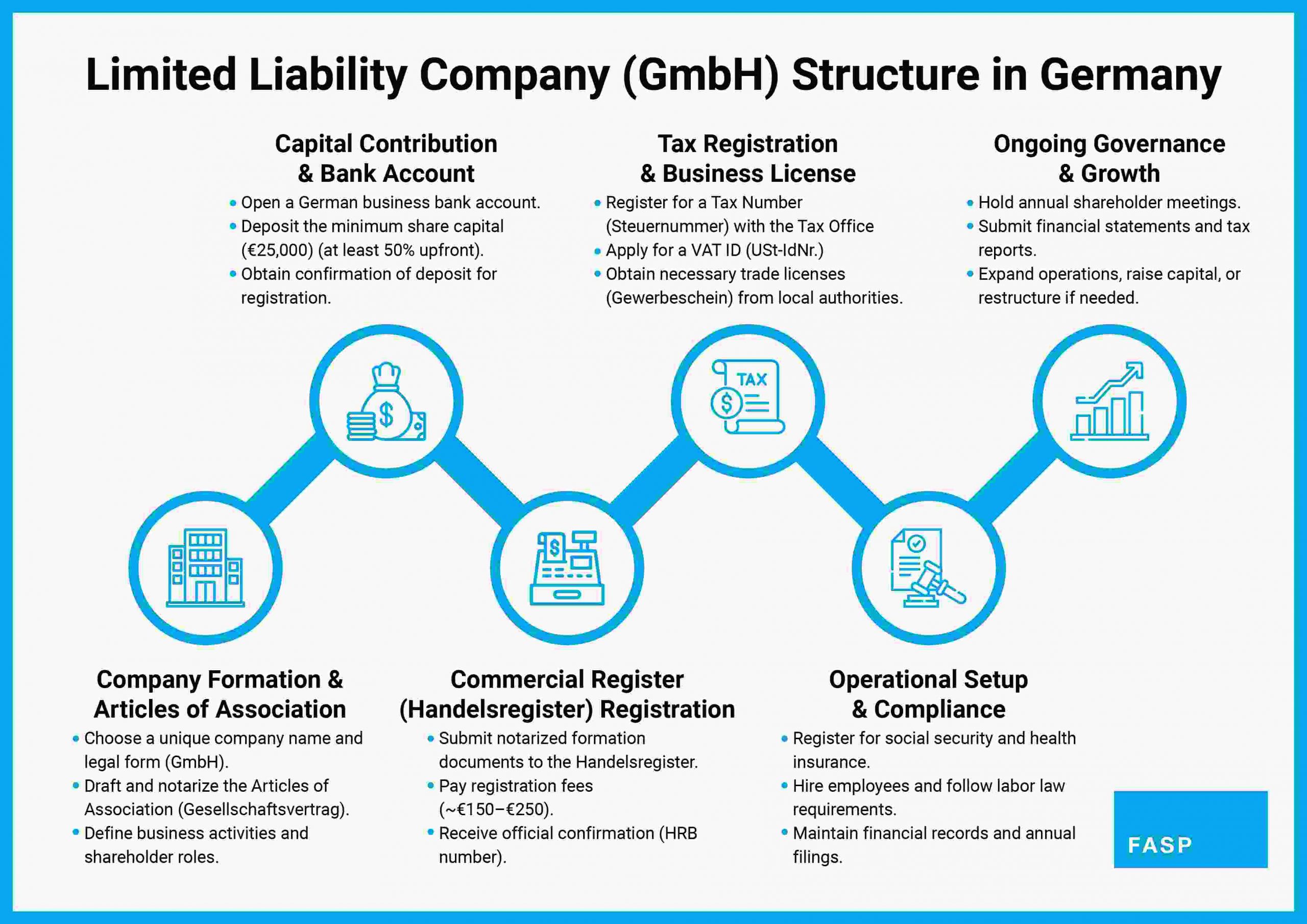

The set up of a GmbH in Germany involves several steps:

- Drafting Articles of Association – The legal foundation of the company, outlining ownership and governance.

- Deposit Share Capital – At least €12,500 must be deposited in a business bank account.

- Appoint Managing Directors – They handle daily operations and legal responsibilities.

- Notarization – The formation documents must be notarized in Germany.

- Register with the Commercial Register – The company gains legal status once listed.

- Register with the Local Trade Office – Necessary for tax and business operations.

The registration process can take up to three weeks, but business activities can start beforehand, provided legal formalities are met.

This capital must be contributed by the owners, with at least half of it being paid at the time of registration. The purpose of this capital requirement is to ensure the financial stability of the GmbH and provide a cushion to cover any potential debts or liabilities.

The capital requirement serves as a safeguard for the GmbH’s creditors, as it provides a level of financial security. It also demonstrates the seriousness and commitment of the owners in establishing and operating a GmbH. Meeting the capital requirements is a crucial step in the registration process, ensuring that the GmbH is compliant with German company law.

Alternative: The Mini-GmbH (UG)

For entrepreneurs seeking a lower-cost option, the Unternehmergesellschaft (UG) allows to form a company with less than €25,000. However, a portion of profits must be retained until the capital reaches the standard GmbH level.

The flexibility offered by the Mini-GmbH enables entrepreneurs to establish a company with limited liability protection while minimizing the initial financial investment. With this lower capital option, entrepreneurs can allocate their resources more efficiently and allocate funds where they are most needed for business operations.

Similar to its counterpart, the standard GmbH, the Mini-GmbH still provides the advantage of limited liability protection for shareholders. This means that the personal assets of the company’s owners will be safeguarded in case of any financial issues or debts incurred by the business.

As owners of a GmbH, shareholders are not personally responsible for the company’s debts or liabilities beyond their capital contribution.

By establishing a GmbH, shareholders can confidently invest in business ventures without risking their personal assets. This not only provides peace of mind but also encourages entrepreneurial activity and promotes economic growth in Germany.

Differences between GmbH and other legal forms

When comparing GmbH (meaning Germany) with other legal forms, several differences become apparent. One key distinction is the limited liability protection it offers to shareholders. Unlike sole proprietorships or general partnerships where personal assets are at risk, GmbH provides a safeguard for the owners’ personal finances.

Another differentiating factor is the flexibility in the structuring of its formation and statutes. GmbH allows for various administrative roles, such as managing directors who oversee day-to-day operations, while shareholders have the power to issue binding instructions to them.

Furthermore, GmbH stands out for its specific capital requirements. Regular GmbHs necessitate a minimum capital of 25,000 euros, whereas there is a lower capital option known as Mini-GmbH. This reduced capital requirement opens up opportunities for entrepreneurs with smaller budgets.

In terms of market presence and reputation, GmbHs hold a strong position in Germany. Their established brand recognition and credibility contribute to their desirability among investors and business partners.

Understanding these differences can help entrepreneurs make informed decisions when choosing the appropriate legal form for their business endeavors in Germany.

GmbH registration process

Registering a GmbH in Germany involves several essential steps to ensure legal compliance and establish the company’s validity.

- Choose a Unique Name: Select a distinctive name for your GmbH that complies with the naming regulations set by the German Commercial Code (HGB).

- Draft the Articles of Association: Prepare the company’s Articles of Association (Gesellschaftsvertrag) to outline its purpose, management structure, and shareholder rights.

- Appoint Directors and Shareholders: Designate the managing directors (Geschäftsführer) responsible for the daily operations of the company and provide a list of shareholders.

- Prepare the Capital Contribution: Determine the capital contribution amount and ensure that at least 50% of the minimum required capital (25,000 euros) is available.

- Notarize the GmbH Contract: Visit a notary public to authenticate the Articles of Association and other necessary documents to establish legal proof.

- Register with the Commercial Register: Submit the required documents, including the notarized GmbH contract, to the local commercial register (Handelsregister) for official registration.

It is essential to follow these steps diligently, fulfilling all legal requirements and adhering to the specified procedures. By completing the GmbH registration process successfully, you can establish a legally recognized company with limited liability in Germany.

Do you want to know more about GmbHs?

GmbH and international trade

GmbHs play a significant role in international trade, leveraging their limited liability structure to engage in cross-border business activities. With their legal status and reputation for reliability, GmbHs have been able to establish strong partnerships and expand their operations globally.

The liability protection offered by GmbHs instills confidence in international partners, making them more willing to collaborate and invest in joint ventures.

Furthermore, GmbHs enjoy the benefits of Germany’s strong international trade network, which includes favorable trade agreements and access to global markets. This allows companies to import and export goods and services efficiently, contributing to their growth and competitiveness in the international arena.

- GmbHs can establish subsidiaries or branches in foreign countries, providing a physical presence and facilitating local operations.

- They can take advantage of international trade financing options, such as export credits and trade finance services, to support their expansion and mitigate financial risks.

- GmbHs can participate in international trade fairs and exhibitions, showcasing their products or services to a global audience and attracting potential partners and customers.

- They can also collaborate with foreign distributors and suppliers, benefiting from their market knowledge and distribution channels.

Financial and accounting obligations for a GmbH

A GmbH in Germany has specific financial and accounting obligations that must be fulfilled. These obligations are essential for maintaining transparency and compliance with the country’s legal framework. Here are some key aspects to consider:

- Annual Financial Statements: GmbHs are required to prepare annual financial statements, including a balance sheet, an income statement, and additional notes. These statements provide an overview of the company’s financial position and performance.

- Auditing Requirements: In general, GmbHs are not obligated to undergo mandatory audits. However, certain criteria, such as company size and the number of employees, determine whether an audit is necessary. Medium-sized and large GmbHs may be subject to mandatory audits by qualified auditors.

- Tax Obligations: GmbHs must fulfill their tax obligations, including corporate income tax and value-added tax (VAT) filings. It is crucial to comply with tax regulations and ensure accurate reporting to avoid penalties.

- Bookkeeping: Proper bookkeeping and documentation of financial transactions are essential. GmbHs must maintain accurate and up-to-date records of all financial activities in compliance with the German Commercial Code (HGB).

- Annual General Meeting: GmbHs are required to hold an annual general meeting (AGM) to discuss financial matters and the company’s performance. During the AGM, shareholders review the financial statements, elect auditors (if applicable), and make decisions regarding profit distribution.

Ensuring compliance with financial and accounting obligations is crucial for the smooth operation of a GmbH in Germany. It is advisable to seek professional advice and support from experts in German accounting and tax regulations to meet these obligations successfully.

GmbH vs. limited companies in other jurisdictions

When comparing GmbHs with limited companies in other jurisdictions, it is essential to understand the unique characteristics of each legal entity. While GmbHs provide limited liability protection to their shareholders, similar protection can be found in limited companies in other countries.

One significant difference is the minimum capital requirement for establishing a GmbH, which is 25,000 euros in Germany. In contrast, the minimum capital requirement may vary in other jurisdictions and can be higher or lower.

The governance structure also differs between GmbHs and limited companies. GmbHs are typically managed by directors, with shareholders providing binding instructions. In some other jurisdictions, limited companies may have a board of directors or a different management structure.

Furthermore, the registration process and legal obligations can vary among jurisdictions. International trade and competition laws may also differ, impacting the operations and legal compliance of GmbHs and limited companies alike.

Investors and entrepreneurs who are considering establishing a GmbH or a limited company in another jurisdiction should carefully evaluate the legal requirements, capital obligations, governance structures, and market presence in each respective market before making a decision.

Insurance requirements for a GmbH

When establishing a GmbH in Germany, you must consider the insurance requirements that must be met. These requirements are in place to protect the interests of both the company and its stakeholders.

First and foremost, you need a comprehensive liability insurance policy for your GmbH. This policy safeguards the company against potential claims and lawsuits, providing financial coverage in case of accidents, damages, or legal disputes. It ensures that the GmbH can fulfill its obligations and continues operating smoothly.

In addition to liability insurance, a GmbH should also consider other types of coverage depending on its specific activities. This may include property insurance to protect physical assets such as buildings, equipment, and inventory. Moreover, employee insurance, such as workers’ compensation, is mandatory to provide protection in case of workplace accidents or injuries.

Furthermore, it is advisable for a GmbH to evaluate the need for professional liability insurance, particularly if it provides specialized services or advice. This type of insurance shields the company from claims arising due to errors, omissions, or negligence in its professional activities.

By fulfilling the necessary insurance requirements, a GmbH can mitigate potential risks, ensure financial stability, and maintain a secure operating environment both for the company and its stakeholders.

Investing in GmbHs: Opportunities and risks

Investing in GmbHs can provide both opportunities and risks for individuals and businesses. Understanding these factors is crucial before making any investment decisions.

Opportunities

- Profit Potential: GmbHs offer the potential for substantial profits, especially if they operate in growing industries or niche markets.

- Protected Liability: As a shareholder in a GmbH, your personal liability is limited to the amount of your investment, providing a level of protection.

- Market Presence: GmbHs are well-established entities in Germany and often enjoy a strong market presence, which can contribute to their long-term success.

Risks

- Financial Instability: Like any business, GmbHs can face financial challenges that may affect their profitability and sustainability.

- Industry Volatility: Investing in GmbHs operating in volatile industries entails higher risks due to changing market conditions and competition.

- Management Issues: Inefficient or ineffective management can negatively impact a GmbH’s operations and overall performance.

Before investing in a GmbH, you need a good due diligence. Assessing the company’s financial health, market position, management team, and potential risks is necessary in making informed investment decisions. Consulting with financial advisors or experts familiar with the German market can provide further guidance.

Market presence and reputation of GmbHs

GmbHs have established a strong market presence and reputation in Germany as reputable business entities. Their legal structure has garnered trust among investors and business partners alike. The GmbH framework provides stability and credibility to companies operating within Germany’s business environment.

GmbHs are known for their reliable and professional approach to business operations, attracting both domestic and international clients. Their commitment to corporate governance and adherence to legal obligations ensure transparency and accountability, further enhancing their reputation in the market.

With their established track record, GmbHs are often seen as trustworthy partners in collaborations, joint ventures, and trade agreements. The limited liability protection offered by GmbHs instills confidence in investors, mitigating potential risks associated with business ventures.

Moreover, GmbHs’ reputation extends beyond their functioning within Germany as they increasingly engage in international trade. Their compliance with international standards and regulations adds to their credibility in global markets, facilitating cross-border transactions and partnerships.

Overall, the market presence and reputation of GmbHs in Germany reflect their solid foundation and credibility as legal entities. Their commitment to professionalism, limited liability protection, and international engagement makes them an attractive choice for investors and business partners alike.

Trade and competition laws applicable to GmbHs

Trade laws outline regulations related to product labeling, advertising, and fair pricing. GmbHs must comply with these regulations to avoid penalties or legal issues. Companies must accurately label their products, provide transparent information to consumers, and avoid engaging in deceptive or unfair trade practices.

In addition, competition laws prevent anti-competitive behavior and prohibit actions that could harm competition in the market. GmbHs need to be aware of these laws, which regulate practices such as price fixing, market dominance abuse, and anti-competitive mergers or acquisitions.

Companies operating in Germany must ensure compliance with these regulations to maintain a fair and competitive environment.

- Adherence to trade laws, including accurate labeling and transparent information.

- Avoidance of deceptive or unfair trade practices.

- Compliance with competition laws to prevent anti-competitive behavior.

- Avoidance of price fixing, market dominance abuse, and anti-competitive mergers or acquisitions.

Common challenges faced by GmbHs

GmbHs in Germany often encounter a range of challenges that require careful navigation and strategic planning. These challenges include:

- Compliance with legal regulations and requirements: GmbHs must stay up-to-date with changing laws and regulations, ensuring their operations align with the latest legal standards.

- Financial management and capital optimization: Managing finances effectively is crucial for GmbHs to maintain stability and maximize profitability. This includes proper budgeting, cost control, and strategic investment decisions.

- Competitive market dynamics: GmbHs face competition from both domestic and international players. They need to develop strategies to differentiate themselves, penetrate new markets, and stay ahead of competitors.

- Recruitment and talent retention: Attracting and retaining skilled employees is paramount for the success of a GmbH. The challenge lies in attracting top talent while offering competitive compensation and opportunities for career growth.

- Technological advancements: Keeping pace with rapidly evolving technologies is essential for competitiveness. GmbHs must adapt and integrate digital tools, streamline processes, and embrace innovation.

- Risk management and legal liabilities: GmbHs must proactively identify and mitigate risks while ensuring compliance with legal obligations. This encompasses data protection, contractual agreements, and potential liability claims.

- Adapting to market changes: GmbHs must anticipate and respond to changing market trends, customer preferences, and economic fluctuations to stay resilient and seize new opportunities.

Successfully addressing these challenges requires proactive planning, strategic decision-making, and effective execution. By navigating these hurdles, GmbHs can position themselves for sustained growth and profitability in the German business landscape.

Future outlook for GmbHs in Germany

The future outlook for GmbHs in Germany is promising, with continued growth and opportunities on the horizon. As Germany remains an economic powerhouse in Europe, GmbHs are expected to play a crucial role in driving innovation, attracting investment, and creating job opportunities.

GmbHs have gained recognition for their flexible legal structure, offering limited liability protection to shareholders and providing a stable business environment. This has positioned them as a preferred choice for both local and international entrepreneurs looking to establish their presence in Germany.

With advancements in technology and evolving market trends, GmbHs are well-positioned to capitalize on emerging sectors such as renewable energy, sustainability, e-commerce, and digital services. As Germany embraces digital transformation, GmbHs are expected to contribute significantly to the country’s economic growth.

Moreover, the ease of setting up a GmbH and the reduced capital requirement through options like the Mini-GmbH have made it more accessible for small and medium-sized enterprises (SMEs) to enter the market. This is likely to further enhance the diversity and competitiveness of the GmbH landscape.

In an increasingly globalized world, GmbHs are also expected to play a vital role in international trade, acting as a gateway for businesses looking to expand their operations into Europe.

As with any business, there will always be challenges and risks. GmbHs need to stay up-to-date with regulatory changes, adapt to evolving consumer demands, and navigate the competitive landscape. However, given their established reputation and the supportive business environment in Germany, GmbHs are well-poised to overcome these challenges and thrive in the future.

FREQUENTLY ASKED QUESTIONS

This article may also be of interest to you: